Indian MINING & CE Industry: INFRASTRUCTURE PUSH to CONTINUE DRIVING INDUSTRY VOLUMES

The domestic mining and construction equipment (MCE) industry has registered a 5% YoY growth in volumes in Q1 FY2025 as per the initial recent data released by the Indian Construction Equipment Manufacturers’ Association (ICEMA). The growth comes on the heels of the industry’s robust performance in the last two years with sales of over 100 thousand units per annum (peak volumes prior to the pandemic were 98,000 units). While the growth rate during Q1 FY2025 has been modest compared to 20% YoY growth seen in Q1 FY2024, the industry was bracing for a contraction in domestic demand in H1 FY2025, in line with the previous election cycles, driven by a slowdown in the new project award activity due to the Parliamentary Elections in April-June 2024 (with the Model Code of Conduct in place) and monsoon-related impact on construction activities in Q2. Nonetheless, the continued strong performance in Q1 reflects customer optimism over the Government’s sustained focus on infrastructure and the consequent impact on MCE demand.

The industry derives over 90% of its sales (by volume) from the domestic market with road construction and mining & quarrying sectors contributing 60-75% and the real estate (RE), industrial and other urban infrastructure sectors driving the rest of the demand. In Q1 FY2025, domestic sales saw a 4% YoY growth with the earthmoving equipment, which remains the largest equipment segment with ~70% share, posting a 5% growth. Concrete equipment reported the highest 8% YoY growth among the five MCE segments, while road, material handling and material processing equipment saw flattish volumes.

Certain high frequency indicators of economic activity, like the Coal India Limited output (mining segment), finished steel consumption and port cargo traffic and rail freight (material handling segment), all of which saw YoY increase during the quarter, partly explain the sustained demand momentum for MCEs. In contrast, road award activity and execution (as per Apr-May data of MoRTH) was slower on a YoY basis. While it’s too soon to rule out a YoY moderation in volumes for FY2025, with the expectation of the policy stability regarding infrastructure-fuelled-development, the new project award activities will likely ramp up faster numbers than previously envisaged in H2 FY2025.

Sustained Government’s push for infrastructure development to continue

Infrastructure development has a multiplier effect on an economy in terms of job creation (direct), efficiency gains for other industries (indirect) and an increase in economic activity leading to additional spending by consumers (induced impact). Hence, there has been (and will remain) a massive thrust on infrastructure by the Government of India (GoI) to realise its goal of a US$ 7 trillion economy by 2030 and of becoming a ‘developed economy’ by 2047. With ~70% of the demand for MCE equipment arising from infrastructure projects, the prospects of the MCE industry thus remain closely linked with that of infrastructure investment.

The GoI has been working on several initiatives to encourage investment and strengthen India’s position as a favoured global manufacturing hub, backed by robust infrastructure availability.

A significant outlay has been committed (and disbursed) for the National Infrastructure Pipeline (NIP), road connectivity programmes (Bharatmala), port infrastructure (Sagarmala), railway network expansion and upgradation, new airports/air routes (UDAN) and water and waste management, among others, which are expected to keep the order books of construction players strong over the coming years. Further, a scale-up in operations/investments by the National Bank for Financing Infrastructure and Development (NBFID) and the National Investment and Infrastructure Fund (NIIF) will provide/facilitate long-term infrastructure funding. Foreign capital inflows in the infrastructure sector (e.g., Roads, Renewable Power etc.), supported by formats like InvITs, are also expected to support India’s infrastructure growth story.

Alongside the Government’s infrastructure push, increasing capacity utilisation of the manufacturing sector, coupled with geopolitical developments (China+1 strategies) have contributed to the gradual revival of private sector investment demand. Private sector project announcements have witnessed a sizeable increase in the last two years, averaging at Rs. 27.2 trillion (FY2023-24) against the average of ~Rs. 9.8 trillion during FY2015-22.

Challenges persist

Given the changing geo-political dynamics and sluggish domestic growth prospects in several developed markets, global OEMs are on the lookout to diversify their supply chains outside China, which presents an opportunity for India to capitalise on the same and increase its share in global MCE manufacturing. Nonetheless, the industry faces certain challenges – foremost being the high import dependence for critical components like undercarriage, precision hydraulics and electronics. Moreover, the availability and cost-competitiveness of key raw materials - speciality steel and alloys – is also a challenge. In certain segments like excavators, the high import dependence exposes the OEMs to fluctuations in forex and international freight costs, besides elongating their working capital cycle, because of the need to maintain higher inventory, thereby impacting their pricing competitiveness (for exports). The absence of any emission regulations for off-highway equipment (given the increasing global focus on sustainable technologies) is a bottleneck for exports, as 30-35% of the current industry production lags prevalent global standards in developed markets like Europe and the USA. The domestic MCE industry already has a strong product line-up and with the debottlenecking of persisting issues, it is poised to emerge as a strong global player in the coming years.

Industry poised for strong growth

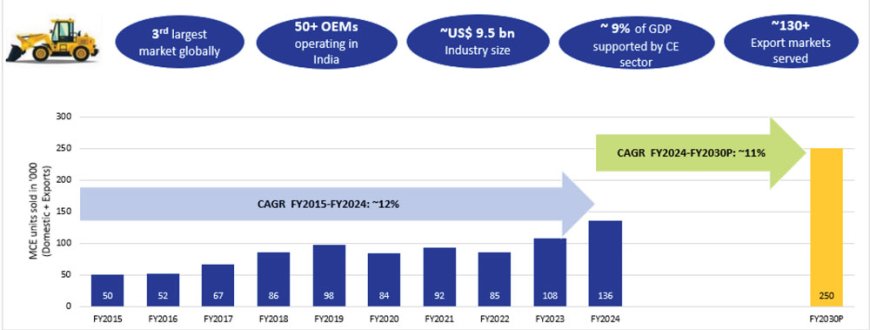

The industry had last peaked at 98,000 units in FY2019 before the COVID-19 pandemic and the change in emission norms (CEV-III to CEV-IV from October 1, 2021) had dampened the momentum. Nonetheless, India overtook Japan as the 3rd largest global MCE market (in volume terms) in 2019 and the stellar performance over the last two years has further cemented this position.

As per ICEMA’s Vision Plan, the industry can become the 2nd largest global market, with annual sale volumes of over 250 thousand units (and annual revenues of over $25 billion) by 2030, which translates into a CAGR of ~11% between FY2024 to FY2030 (vis-à-vis 12% CAGR between FY2015-FY2024) despite the higher base. This will be driven by the increasing size of the projects (several mega projects coming up like high-speed rail, river linking projects etc.) and the introduction of higher mechanisation levels and technologically advanced equipment to ensure timely implementation. Given the increasing focus on localisation, the domestic vendor eco-system of the MCE industry is also expected to benefit, with their revenue growth rate likely to outperform the ~17% revenue CAGR expected by the OEMs during the FY2024-2030 period.

Ritu Goswami