Indian Construction Equipment Industry sales for Q2 FY24 record 31% YoY growth

The Indian Construction Equipment industry consolidated its positive performance in the current year as CE sales grew by an excellent 31% in Q2 of FY 2023-24, as compared to Q2 of the last fiscal year. Total equipment sales in Q2

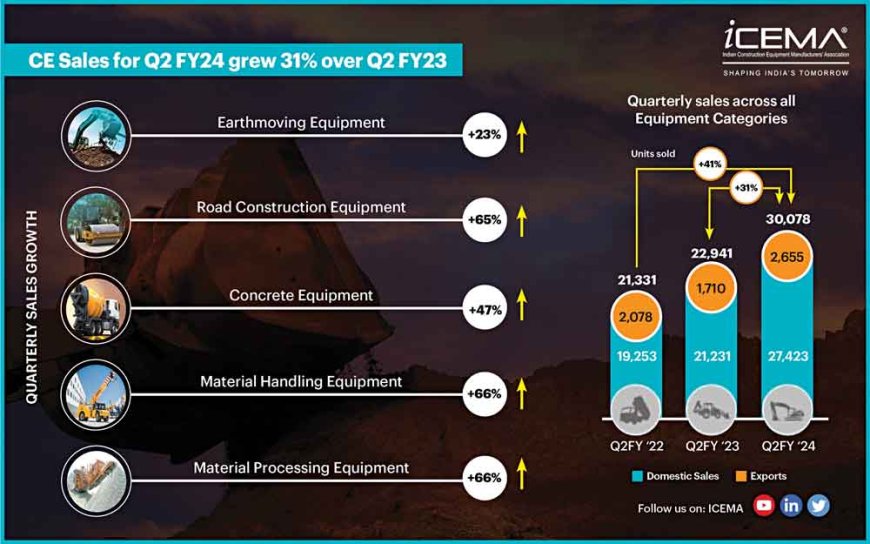

The Indian Construction Equipment industry consolidated its positive performance in the current year as CE sales grew by an excellent 31% in Q2 of FY 2023-24, as compared to Q2 of the last fiscal year. Total equipment sales in Q2 24 increased to 30,078 units, against 22,941 units sold in Q2 of FY 2022-23. Of these, domestic sales accounted for 27,423 units while 2,655 units were exported.

The Indian Construction Equipment industry thus continues to be a key enabler of creation of world-class infrastructure in the country, ably partnering the Government in its drive for infra-led growth of the nation. The Union Budget 2023-24 further reiterated the government’s focus on infrastructure development as the engine of economic growth in the country through increased budgetary allocations, including the second highest allocation to Road infrastructure, amounting to 20% of the total allocated budgetary expenditure. This has translated into greatly improved prospects for the CE industry, since road construction accounts for around 40% of the total demand for construction equipment in the country. Further, the current fiscal being an election year, the projects that were already in the pipeline, as well as those that started recently, are expected to be completed well in time, providing added impetus to the growth of the CE industry.

“The extremely encouraging sales growth in the second quarter of the current fiscal year is largely a result of increased momentum in implementation of infrastructure projects,” said V. Vivekanand, President ICEMA and Managing Director, Caterpillar India Pvt. Ltd. “The 17% increase in budgetary allocation to the infrastructure sector and 15% increase in the budgetary allocation to NHAI are showing encouraging results in the form of pickup in the pace of infra projects,” he explained. “The rapid pace of projects that were in the pipeline, especially in railways as well as the roads and highways sector, has generated spectacular increase in demand for all segments of construction equipment,” he concluded.

The growth in sales during the second quarter of the current fiscal comes on the back of positive growth in all five of the CE industry’s major equipment segments, viz., Earthmoving Equipment by 23%, Road Construction Equipment by 65%, Material Handling and Material Processing Equipment by 66% each and Concrete Equipment by 47%. Earthmoving Equipment, which has a 70% share in total construction equipment sales, recorded total sale of 20,669 units, which were primarily comprised of backhoe loaders (11,756 units) and crawler excavators (6,765 units). Pick and carry cranes (3,383 units) constituted the bulk of Material Handling Equipment sales while Concrete Equipment sales were largely accounted for by Concrete Mixers (1,990 units).

On a quarter-on-quarter basis too, overall CE sales in Q2 FY24 recorded a 10% growth with over 27,244 units sold in Q1 FY24. The segment-wise Q-o-Q growth has been positive across the board, with 10% growth in Earthmoving Equipment sales, 13% in Material Handling Equipment, 17% in Concrete Equipment and 1% each in Road Construction and Material Processing Equipment segments. Industry experts explain that while the low base of Q2 23 might be a partial factor in the Q-o-Q growth recorded in Q2 24, a clear increase in state Capex on infrastructure has resulted in increased construction activity at the local levels as well, especially in PWD projects. This in turn, has generated additional demand for construction equipment in the second quarter of the current year.

Within the month of September 2023, overall CE sales increased 22% month-on-month to 11,930, as compared to 9,796 in August 2023. Except for Material Processing Equipment sales, which dropped 6% in September ’23, all the other segments registered positive M-o-M growth – Earthmoving Equipment by 27%, Material Handling Equipment by 12%, Road Construction Equipment by 33% and Concrete Equipment by 3%. The industry sold 8,468 units of Earthmoving Equipment, 1,166 units of Concrete Equipment, 1,513 units of Material Handling Equipment, 557 units of Road Construction Equipment and 226 units of Material Processing Equipment in the month of September 2023.

“We are very pleased with the sales growth in Q2 of the current fiscal and expect the positive trend to continue,” said Jaideep Shekhar, Convener, ICEMA Industry Analysis & Insights Panel and Managing Director – Asia, Australia & EMEAR, Terex India Pvt. Ltd. “In view of the government’s directive to spend 80% of the budget allocation for the infrastructure sector by December 2023, we are confident that this ongoing momentum will translate into a 15-20% growth in CE industry sales over the whole of FY24,” he explained.

The Indian CE industry recorded exemplary annual results in the previous fiscal, with sales crossing the 100K unit mark for the first time ever and an unprecedented 26% annual growth in sales volumes. Following this, the Indian CE industry’s performance in the current fiscal year has been further bolstered by the Government’s continued emphasis on infrastructure in the form of enhanced Budgetary allocations, as well as rapid implementation of projects in the run-up to the General Elections. As a result, the overall sales figures for the CE industry in the current fiscal year have been consistently higher than those in FY 2022-23, in terms of both domestic sales as well as exports.

Vivekanand, as the spokesperson of the Indian CE industry, further added, “We at ICEMA request the government to ensure that the steady pace of execution of projects is maintained, to ensure the continued robust growth of the Construction Equipment industry.” He further added, “ICEMA, as the apex body of the CE industry, continues to work towards the growth and advantageous positioning of the industry through stakeholder engagement, consensus building and policy advocacy.”

The ICEMA Panel on Industry Analysis and Insights provides robust and credible market intelligence by collating, generating, and analysing industry data. The value-added quarterly CE Industry Report is among the several industry reports collated based on data shared by its member companies which represent about 95% of the OEMs operating in the Indian Construction Equipment industry.

ICEMA (Indian Construction Equipment Manufacturers Association) is the nodal body representing the Construction Equipment industry (OEMs, suppliers and Financial Institutions) in the country and is affiliated to Confederation of Indian Industry (CII).

Hits: 10