INDIA MINING INDUSTRY

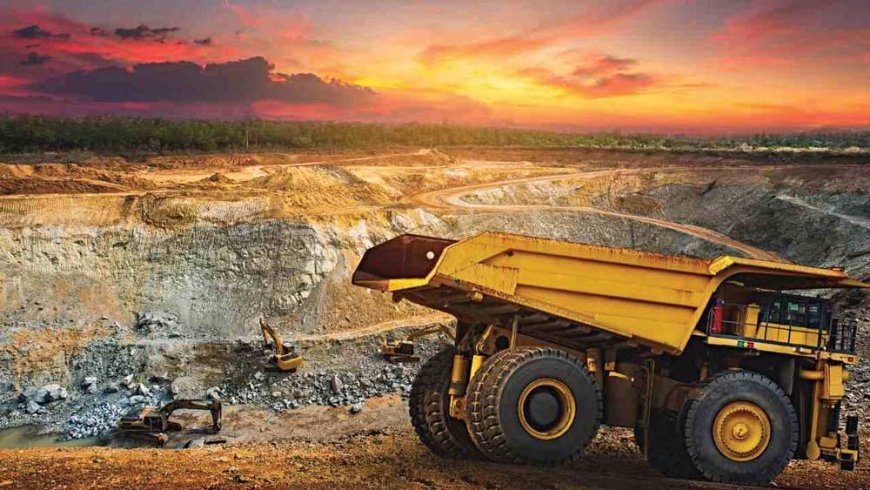

In India, the mining sector is one of the core industries of the economy and it has witnessed significant growth in the past few years.

In India, the mining sector is one of the core industries of the economy and it has witnessed significant growth in the past few years. In terms of trends, positive signs in the manufacturing and mining activity recorded a higher relative growth performance last year. The mining policy has been introduced with the objective of increasing revenue, production, employment, and operations in order to boost economic output.

India produces nearly 95 minerals, including 4 fuel, 10 metallic, 23 non-metallic, 3 atomic, and 55 minor minerals (including building and other materials). During 2021-22, India’s mineral & ore was reported from 21 States/Union Territories of which the bulk of the value of mineral production (excluding fuel and atomic minerals, and minor minerals) of about 88% were confined to 4 States. Odisha spearheads the India mining sector, in terms of the estimated value of mineral production in the country and accounts for of 47% in the domestic output. Chhattisgarh follows Odisha with a share of 16.2%, followed by Karnataka (14.3%), Rajasthan (11%), and Jharkhand (4.5%) in the total value of mineral production.

In terms of production, India ranks 2nd in Steel (crude/liquid), 3rd in aluminium (primary) & Chromite; 4th in iron ore, lead (refined) & Zinc slabs; 5th in Bauxite, 7th in Manganese ore, 13th in copper (refined), 16th in apatite & rock phosphate and 17th in Magnesite.

Market Drivers

The growth of the mining industry is driven by development in the automotive & transport industry, advancements in processing equipment and manufacturing technologies, and an increase in the usage of minerals in various industries such as building & construction, and packaging. In terms of consumption growth, India is one of the leading regions, due to massive urbanization, growth in income of people living in urban areas, and rapid industrial development. Additionally, continuous advancements in the automotive and aerospace industry and ongoing R&D activities to develop innovative, cheaper, and effective products fuel the growth of the market.

Furthermore, domestic demand for Copper and Aluminium is expected to be strong on the back of an improved outlook for industrial and infrastructure growth. The government’s thrust on the energy and power sector, smart city, Housing for all, harnessing renewable energy resources, electric vehicles, infrastructure development, Atmanirbhar Bharat Abhiyan, and Make in India spells good news for the India mining industry. The per capita copper consumption in India is expected to increase from the current level of 0.6 Kg to 1 kg in the coming years. Importantly, the average per capita copper consumption in the world is 3.2 kg.

Attractive Macroeconomic Scenarios

- In June 2022, the industrial performance index of eight core industries stood at 143.4, mainly driven by the production of coal, cement, electricity, refinery products, fertilizers, steel, and natural gas.

- In FY 2021-22, exports of iron ore stood at US$ 2.5 billion as compared to US$ 5.0 billion in FY 2020-21.

- The steel production in India is projected to increase by 18% to reach 120 million tonnes by the end 2022.

- Between April 2021 and February 2022, exports of coal, mica, and other minerals including processed minerals, stood at US$ 2.9 billion.

- The metals & mining sector has seen some developments, investments and support from the Government in the recent past.

Challenges in India’s Mining Industry

With huge mineral deposits, India’s mining sector is still suffering from legacy issues. According to the assessment, 1% growth in the mining sector pushes up the growth rate of industrial production by 1.2-1.4%. Some of the protuberant challenges across the India mining market include the exploration of mineral resources, land acquisition forest and environment, capital investment, and the latest technology & modernisation.

Mining Equipment Market in India

India is one of the fast-growing economies in Asia and the world. Currently, the India mining equipment market is estimated at 620-630 units per year for the last 4 years. Nevertheless, RationalStat expects the India mining equipment market to observe a healthy demand and expects the market to grow by more than 12%. The tailwinds for different demand drivers are expected to ensure that such growth continues at least for 6 years till 2028.

In terms of segment share, Dump Trucks constitute around 65% of the total fleet of mining equipment in India. Other prominent mining equipment used in opencast mines are Hydraulic Equipment, Wheel Loaders, and support equipment including Dozers, Motor Graders, etc.

India’s Competitive Advantage

India holds a strong foothold in the mining sector across the world against the backdrop of a fair advantage in production and conversion costs in steel and alumina. India’s strategic geographic location enables export opportunities to develop. It is estimated that the number of reporting mines in India is 1,425, of which mines for non-metallic minerals are 720, and mines for metallic minerals were estimated at 525.

Key Events and Developments in the India Mining Industry

- The government plans to monetize assets worth INR 28,727 crore (US$ 3.68 billion) in the mining sector over FY 2022-25.

- In November 2021, JSW Steel announced a 6% YoY surge in crude steel production at 1.42 million tonnes in October 2021.

- In November 2021, AMNS India announced that it is planning to manufacture specialty steel under the production-linked incentive (PLI) scheme.

- Vedanta Limited is planning a US$ 20 billion investment across its operations, including increasing silver production and steel capacity.

- In June 2021, Mr. T.V. Narendran, the CII President and Managing Director of Tata Steel, stated that steel firms have firmed up plans to invest INR 60,000 crore (US$ 8 billion) over the next three years in this sector.

- In May 2021, Vedanta Ltd. announced its plan to invest INR 10,000 crore (US$ 1.34 billion) in setting up an aluminium park in Odisha to facilitate companies that use metal to set up their manufacturing units in the facility.

- In May 2021, ArcelorMittal Nippon Steel (AMNS) signed a contract with Total (a France-based energy company) for the supply of up to 500,000 tons of liquefied natural gas (LNG) per year until 2026.

- In February 2021, ArcelorMittal-Nippon Steel India, in agreement with the Odisha government, planned to set up an integrated steel plant (with 12 MT capacity) in the state’s Kendrapada district for INR 50,000 crore (US$ 6.89 billion).

- In February 2021, two new iron ore mines were inaugurated in Odisha, with a production capacity of 15 lakh tonnes per month and ~275 million tonnes of consolidated iron ore reserves. These mines will bring in INR 5000 crore (US$ 680 million) in annual revenue for the state and employment opportunities for locals.

Technological Trends

The government-run Coal India recently announced that it is exploring green mining options to minimize adverse environmental impact by leveraging eco-friendly technologies in its underground and open-cut (OC) mines. Coal India is striving to ramp up its UG production by 4 times to 100 million tonnes by FY 2030 from 25.6 million tonnes in FY 2022. CIL is planning to deploy 10 high wall machines in its open-cut mines during the upcoming year with a projected production potential of 5 million tonnes per year.

Furthermore, BEML is also developing the newest technology in mining equipment and upgrading old equipment with advanced technical characteristics based on equipment appropriateness and market input.

Maintenance Practices

The mining industry is a capital-intensive industry and a continuous increase in demand for mineral/ore as per production target requires high productivity and increased availability. Most mines are subjected to implementing checklists, changing work schedules, improving training, enhancing emergency response plans, and launching new safety programs. The best single way to improve maintenance safety is to use safer equipment.

Some of the cited maintenance practices based on research:

- Using high-reliability equipment with the ruggedness

- Timely preventive maintenance

- Scheduling the maintenance cycle

- Introducing newer KPIs for the maintenance

- Timely change/refill of consumables

- Constant communication and consultations with equipment distributor or OEM

- Use of genuine parts.

Hits: 116