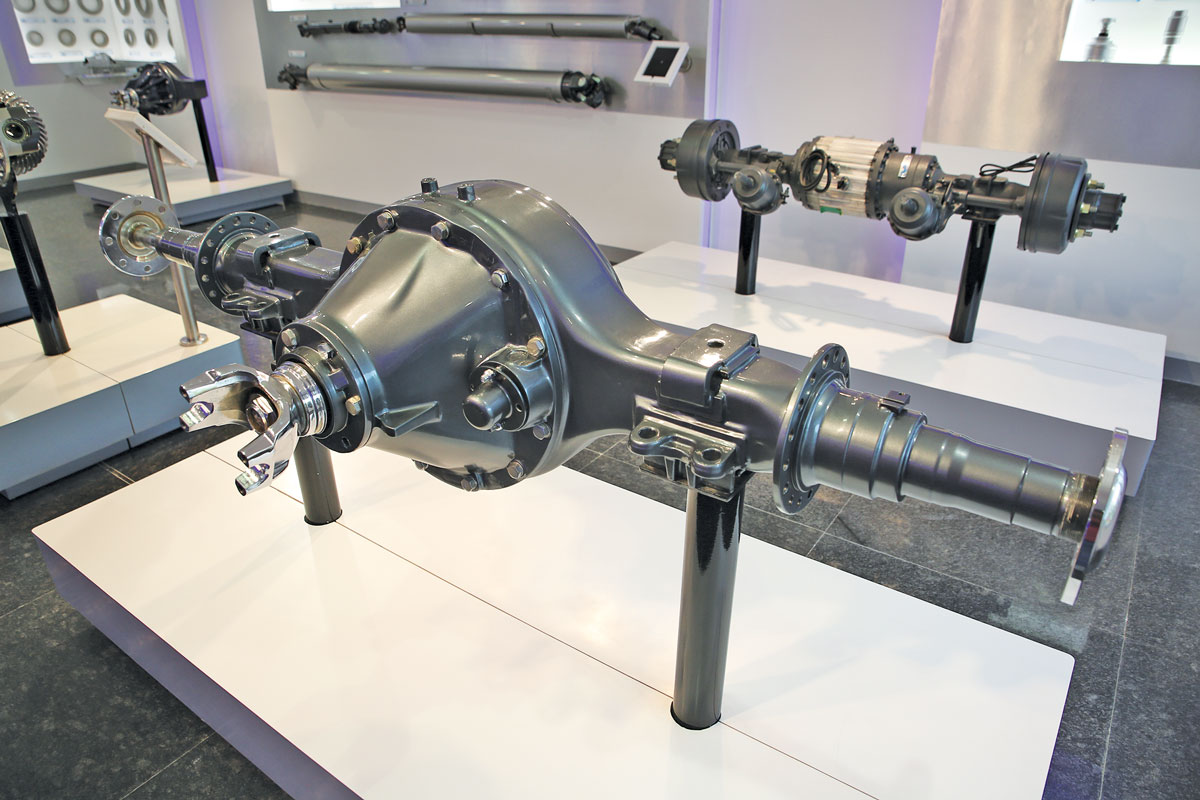

Dana is present in almost all the CE & Mining applications not only in India but across the globe

The Indian construction equipment (CE) Industry is expected to grow by 4% in 2022 compared to 2021 as per Off-highway research. The industry is further expected to grow by 9% in 2023.

– SANDEEP KHULLAR

Executive Director, Dana India Off-Highway & Commercial Vehicle

What is your future outlook for the Indian Component Manufacturers of construction and mining equipment?

The Indian construction equipment (CE) Industry is expected to grow by 4% in 2022 compared to 2021 as per Off-highway research. The industry is further expected to grow by 9% in 2023. National Monetisation Pipeline (NMP) period: Coterminous with National Infrastructure Pipeline (NIP)-4 Years (FY 22-25), the Indian government is expected to spend ~ 75 billion Dollars on projects like Roads, Railways, Power Transmission, Power Generation, Natural Gas Pipeline, Urban Real-estate, Telecom, Warehousing, Mining, Aviation, Ports, Stadiums, etc. which will definitely fuel the growth of CE & Mining equipment in India thus paving the way for the growth of components as well. Government initiatives like AatmaNirbhar Bharat, through PLI (Production Linked Incentive), are further attracting investments in India for components. Supply chain & manpower availability concerns might disrupt the growth in the near future due to rising concerns about Covid 19 across the globe.

As the year has ended, how do you look at the performance of your range of products in terms of sales?

Dana is present in almost all the CE & Mining applications not only in India but across the globe. With a wide range of product offerings to our customers, we have seen double-digit growth in our CE & Mining products

Give us an understanding of your company’s performance in the last 3 years?

The last three years, 2019, 2020, and 2021 have been quite challenging in terms of business scenarios. 2019 was a lean year itself as 2018 was a record year for off-highway equipment sales in India. This was followed by the Coronavirus pandemic in early 2020 thus registering a degrowth. 2021 has been a good year for Dana OH sales as we could break the benchmark record of 2018 sales and for last 3 years we have seen CAGR of >25%.

We continue to see strong growth with our customers, and we have plans to expand production capacity to support new customer programs at nearly all of our facilities in India, including Sanand, Noida, Pune, among others.

What is your future strategies at a time when technological disruptions are rapidly defining businesses in the sector?

Dana has been actively working on green initiatives for the past several decades and with this vision in mind, we could emerge as market leaders in off-highway electrification offering for applications ranging from soil Compactors, Mobile Elevated Work Platforms, Mini excavators, tractors, etc. Dana has an Indigenised electric motor manufacturing facility that is capable of making low-voltage, and high-voltage motors and controllers for various applications in India. Dana has always been ready ahead of the market demand when it comes to new technologies.

To date, globally Dana had invested more than a half billion dollar in EV system capabilities. We are already seeing results from our investments. Dana globally is approaching more than $700 million in sales from electrified systems in 2023 and this is expected to continue to grow significantly.

What are the potential new areas for expansion and proposed new launches for the year 2023?

Dana invested ~ 10 m$ in a state of art new facility in India to provide localized Motor and inverter solutions in E-mobility. The production of a new generation of low-voltage motors is scheduled for 2023 which will help Dana to cater to new applications like Golf and utility vehicle markets. We are also expanding our product portfolio in MEWP (Mobile elevated work platform) in India.

In the future, we expect electrification to become a driver for growth as we ramp up global production of motors and inverters to support new customer programs.

What are the challenges that you face and what are your suggestions to further ease a business-friendly climate?

There is a major mismatch in the expectation of production forecast visibility between CE OEM’s and tier-2 component suppliers like semiconductors, electronics chip manufacturers resulting in challenges for Tier-1 suppliers to meet OEM’s production demand. The localization of critical electronics components in India will help ease these supply challenges and save precious forex for India.

For India, the ‘Make in India’ policy will help kick off the electrification industry by bringing the manufacturing of batteries, motors, inverters, power controllers, and other accessories into India. We believe that EVs have a role to play in the Indian market and therefore are making investments in India for EVs.

Hits: 9